Looking Back at Chart From 2008 - Why Markets Will Crash - This may happen before the end of this month, or end of this year, possibly Q1, 2016, but it's almost certain that markets will crash due to lax monetary policy that has gotten way too big, and has gone on for far too long. Failure to understand how the system works, and what real risk really is, is to an investor's own peril.

Before the crash happened in September 2008, the chart was showing us some signs of what was coming. As many of you are my subscribers, you know I have been talking about " the peeling chart" for some time now. Let's take a look at what I said before;

In this article, I stated:

"I don't like the $SPY chart although today looks like a bounce back for the time being. This chart reminds me of almost an identical move we saw in 2008 before that market went into the tank."

I also went on to state:

"Each time, the upper band stayed in line with the upper line Notice now how it's beginning to peel away/ make a right rounding turn away in tight banding from the upper line? This is exactly what it did in 2008 as well. This bounce from the 200 day needs to clear the upper pivot convincingly. It looks to me that it will not, so please be careful!"

Let's see what I was talking about in an illustration:

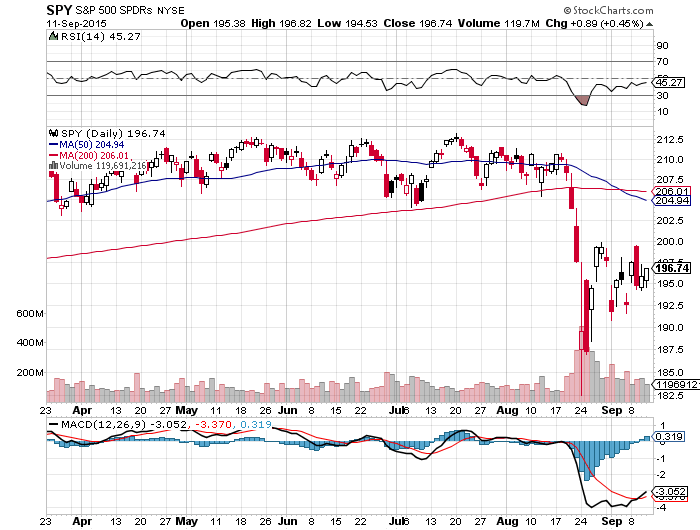

The above chart was on July 28th of this year in which I clearly illustrate the "peel away" pattern. I believed this pattern would continue over a longer period of time and then we would see the big correction. However, it played out a bit differently as the peel away resulted in a much quicker and violent down move to $SPY $182.41, almost touching the October 2014 lows -- something I did not see happening so fast.

Here is the current $SPY chart:

Here is the chart from 2007-2008 which I added a white line to show the similarity of what happened after a big down turn in the 2007 chart:

The problems actually started in January of 2008, as we can see before that time, the market made a bunch of peaks then began to "peel off." Note the attempt at the V trade bounce back which I mark with a white line. The Red line mark is there to show you this;

This is why I state it's possible to get back to $204, even $207 if Fed delays rate hike this week. However, the Fed delaying the rate hike and each potential subsequent delay of said hike will only make the eventual crash more severe. This could actually be their plan believe it or not, and it would be a very unwise thing to do, because they could actually lose control of the entire market, which would result in a crash FURTHER BELOW that of 2008. That's right, a Dow that would see its lows below 6500 = over a 70% correction from the highs.

It's my STRONGEST opinion EVER, that if we get a "no fed rate hike" relief rally, that we use it to CLOSE or GREATLY reduce LONG positions, and even consider shorting into it.

I'm going to have a few more write ups and videos explaining why the fed taking no action can and will result in a much greater market crash. Basically, human nature does not change -- easy money policies that go on too long create an easy money normalcy bias. The majority of money managers get too used to taking incredible risks with BORROWED money because many of them simply have never felt the pain of a crash and do not know any better because no real regulation was put into effect after 2008.

These people only know a fed that GIVES, and not a fed that TAKES away.

When asset prices stay too high for too long, there remains little room for increased leverage as leverage is ballooned to the hilt. The Global financial system scam was exposed/crashed in 2008, and has never truly recovered. Think of the current market as a Zombie and/or a drug addict's induced drug high the last 8 years. The system was never allowed to TRULY crash, to truly reset itself naturally.

So, who will lever who now? China? China's shadow banking system is slowly being exposed. Europe? The ECB QE has had a very little positive effect there and will likely not succeed. Take a look how The Swiss took their pain in order to isolate themselves. This is what the USA should do, and do it now which is why a rate hike is not only needed, we need one of at least 1%, not simply 0.25%.

Normally, a mere 0.25$ raise of the fed fund rate would be nothing. The problem lies mostly in banks levering each other up for years now with impunity. Some argue that banks really don't do this and use their reserves. That is TOTAL NONSENSE as we can clearly see the ER's which were $20B in 2008, are now in excess of over 2.5T, yes, Trillion!

Banks hoard the excess reserves and earn IOER's (Interest on excess reserves), they have no reason to use this money to buy stocks, and they lend out money that's levered/borrowed at a substantial premium because again, it's done so with the illusion of "no risk." Why do they feel there is no risk? DERIVATIVES, the same derivatives Warren Buffet calls "weapons of mass destruction." When people fail to understand how and why these derivatives kick in and how they will likely cause a massive global financial meltdown, they do so at their own peril -- better learn, and learn fast!

Any Fed Fund rate hike would instantly cause a mass deleverage and liquidity dry up. People who again focus on the ER's as liquidity and ignore the complexities of the system are in fact clueless how the system really works.

Yes, we would see a market crash, we would feel the pain, but if we leave things alone and let everything work itself out, we will BE MUCH BETTER for it in 5 years time or less if the fed allows the reset. America could isolate and learn to produce more for ourselves instead of relying on other countries to consume from and truly become a strong nation. Maybe I'm an idealist, but I think this is possible, but sadly not likely because of the elite and their corrupt hoarding ways - damned be everyone else! The real question will be - damned be you?

Again, the real threat is the derivative market. You know, Credit Default Swap, CDO, etc, etc. These are instruments of financial Armageddon and if they kick in (likely), only the upper 1% will have any wealth left. The rest of us will be left holding the bag for literally pennies on the dollar.

When the big crash occurs, will you blame, Bush? Obama? Your Broker? You shouldn't, you should solely blame yourself as all of us have had and still have ample warning here.

Disclosure - I'm Long only one stock - $INVE, and for a small amount. I have no other long or short positions in shares or options in the stock market. I am considering taking a short position but at this time, have not yet done so.