Identifying undervalued developmental Biotech companies that have the potential for a turn-around story, swing trade and/or investment can often times be rewarding.

Five Prime Pharma could be such a turn-around story with a deep pipeline and recent form 13D filed by BioValue Fund.

The company has several assets with catalysts this year, notwithstanding that BioValue Fund is now an activist investor in the name.

When a fund files a 13D, it indicates that it intends to be an activist investor. Activist investors often facilitate new business paths, partnerships, and acquisitions.

We have identified Five Prime Therapeutics (FPRX) as a potential turn-around story with upcoming pivotal data, an activist biotech fund with nearly 22% ownership, and important business decisions this year than can make this company a very large multi-bag gainer, or can break them if handled improperly. Several of the company’s clinical assets. along with Bristol Myers Squibb (BMY) with presenting 'actionable' data this year from the ongoing phase 2 study of Cabiralizumab (Cabira) and Nivolumab (Opdivo), with and without mFOLFOX (chemotherapy) in pancreatic cancer, are facing what the interim management team calls a “go or no-go” decisions.

One of the main tasks for FPRX management here is to narrow down where to best deploy resources and where capital burn can be pared back while creating shareholder value. Based on our understanding of the company's last earning's call in Nov. 2019, FPRX's direction now is to take a more measured and rational approach to capital management as opposed to the over aggressive strategy of the previous management team.

At this price point and with multiple shots on goal, we feel that FPRX offers an excellent risk reward proposition as a bet on a turnaround story that can net substantial return from the current valuation.

For starters, the Cabira decision to go or no go will be in great part decided by BMY, as BMY has the lead here in this asset.

In 2015, BMY made a deal with FPRX for Cabira shelling out $350 million upfront to the company, and back-ended $1.74B in potential development and regulatory milestone payments; additional double-digit royalties on future sales, and the option to co-promote in the U.S.

There will be additional more robust data from this asset to read-out this year, with data expected some time in the 1st half of this year.

We see this asset as a potential value add-on for FPRX. It's not expected to produce good results, so most of its downside is likely already baked into the stock price, as evident from the initial data read-out in Pancreatic cancer which was disappointing, but not entirely useless.

At the time of the initial 'disappointing' read-out on Cabira, FPRX stock was trading in the mid $40 range. With the stock now trading around $5 a share the expectations here for Cabira are low, as it's not expected to produce the type of data needed to be a needle mover. However, if better data emerges with Cabira it should help with stock price appreciation.

What is of primary interest to us and most investors is the company’s Bemarituzumab (Bema, anti-FGFR2b antibody) program being developed in FGFR2 over-expressing gastric cancer. The primary endpoint for the current phase 3 study is examining chemotherapy with Bema, with the bar set for the company’s planned futility analysis as Overall Survival (OS).

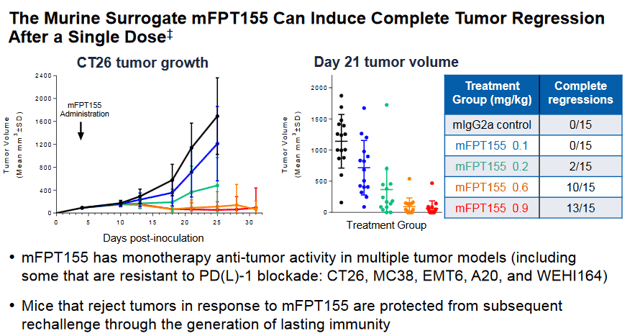

Informing this phase 3 was the encouraging single agent activity in heavily pre-treated gastric and gastroesophageal junction (GEJ) cancer patients (the single agent data presented at ASCO in 2017 is shown below). In short, this single agent salvage data showed an ORR of 19% (impressive within the context of a wide-open unmet need here) in patients who have high expression of FGFR2b as determined by biopsy. With a low Severe Adverse Events (SAE) rate, the company aggressively advanced this agent into a phase 1 / 3 trial in combination with mFOLFOX.

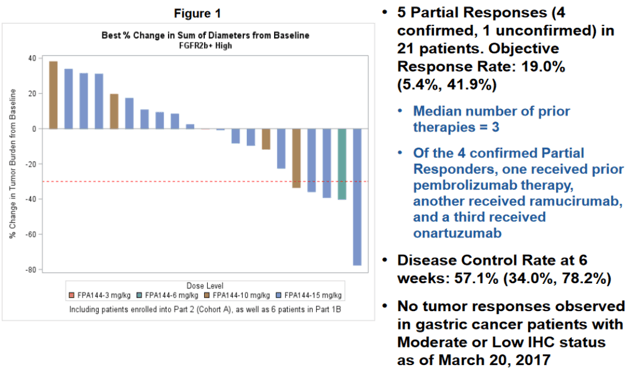

Upon following up the mono-therapy study, the company found that achieving a trough plasma concentration of 60 μg/mL was necessary for responses. As such, dosing has been adjusted to achieve this concentration of Bemarituzumab.

Upon following up the mono-therapy study, the company found that achieving a trough plasma concentration of 60 μg/mL was necessary for responses. As such, dosing has been adjusted to achieve this concentration of Bemarituzumab.

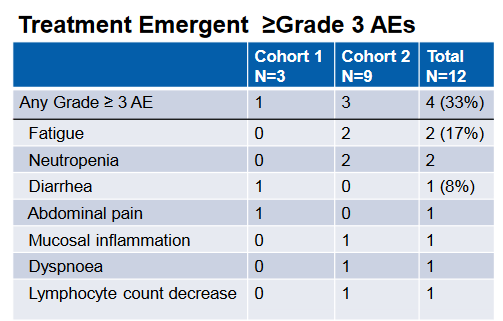

In the phase 1 portion of the phase 1 / 3 study, the combination was evaluated primarily for safety, which was deemed acceptable given the lack of dose limiting toxicities and a 3/9 SAE rate for the combination at the high dose. This was a broader enrollment population than the phase 3 which is purely looking at gastric cancers. Here also, colorectal and pancreatic patients were also involved in the study. The safety profile is summarized below. Though the study was not geared to look at efficacy, 2 PRs were observed in the enrolled patients;

According to the original phase 3 study design, the initial goal of 548 patients was estimated to have 80% power to detect an OS HR of 0.75 in favor of the Bema + chemotherapy arm. One possible positive outcome here is that when analysis is done at the interim cutoff, it is determined that less patients will be needed to achieve a statistically significant signal.

Another possible positive outcome here although unlikely, is that the FPRX will stop the trial early for efficacy, that is if the company can narrow down an effective cutoff. If a strong efficacy signal is achieved at interim or final analysis, we would expect Five Prime to pursue an Accelerated Approval (AA) pathway for Bema given the unmet need and poor prognosis of the target population.

High FGFR2 expression has been generally associated with poor prognosis by multiple studies. In a meta-analysis of 4,294 patients across ten studies, showed an OS Hazard Ratio (HR) of 1.40 (or 40% higher rate of death in FGFR2 over-expression). In addition, these tumors showed an 87% higher odds of lymph node metastasis. All of these studies took place in Asian region where FGFR2 over-expression and gastric cancer itself is more common.

However, there has yet to be consensus on how FGFR2 amplification should be determined or what a cutoff should look like. As a result, some studies put the prevalence of this mutation as high as 61.4%, and as low as 2.5%. So far, Five Prime has reported a prevalence of FGFR2b over-expression at 30% based on pre-screening data for the study.

On clinicaltrials.gov, the company lists its inclusion criteria as “FGFR2b over expression as determined by a centrally performed IHC tissue test and/or FGFR2 gene amplification as determined by a centrally performed ctDNA blood based assay”. To qualify on the basis of immunohistochemistry (IHC), patients must score a 2+ or a 3+ from biopsy.

This leaves the company a lot of room in its mid-2020 futility analysis of the 140 patients enrolled to not only determine the correct number of patients to ensure adequate powering, but also narrow down the best cutoffs for FGFR2 - ctDNA levels for these patients. Emphasizing a biomarker based on a blood test will significantly boost compliance, as well as account for the variability from heterogeneous expression.

Interestingly, the company reported closing its centers for enrollment to study these 140 patients. However, clinical trials.gov shows that centers in Japan are still open for enrollment with the additional of a new center added as of the December 9th. 2019 update. Given the high prevalence of gastric cancer in Japan, we think it is possible for the company to pursue another deal for this nation similar to the Zai Labs (ZLAB) deal governing Bema development in greater China.

FPRX also has assets targeting B7-H4 (FPA150) and CD80 (FPT155), two potentially compelling shots on goal in the immuno-oncology space. Both of these programs are also subject to a “go or no go” decision following data read-outs in 2020.

FPA150 is being examined in ovarian cancer in combination with Pembrolizumab (Pembro, Keytruda), Merck’s (MRK) anti-PD1 antibody. Ovarian cancer is a setting with a known high incidence for B7-H4 over expression. The combination was found to be well tolerated, with no SAEs found to be treatment related. The company therefore has decided on expansion at a recommended dose of 20mg/kg in combination with full dose Pembro.

It’s worth noting that as a single agent, FPA150 showed 2 partial responses in ovarian cancer. This is a setting that IO typically struggles in, with mono therapy Pembro data showing responses in the single digits. Given that B7-H4 is hypothesized as a means to overcome escape from PD-1 inhibition, a low bar, and the predisposition for B7-H4 over-expression in ovarian patients, we feel FPA150 offers another compelling shot on goal.

FPT155 is still exploring dosing and is the least developed clinical program for Five Prime, but potentially the most differentiated. As of the update at The Society for Immunotherapy of Cancer (SITC) in November of 2019, the drug was in the 8th escalation dosing cohort with Maximum Tolerated Dose (MTD) not yet been reached, in addition to the PK profile being consistent with increases in dosing.

FPRX, along with the FDA opted for a safer and slower dose escalation design due to the potential for cytokine release syndrome (CRS). This is because the drug works through the CD28 pathway, which has high potential for CRS. However, the model does indicate that co-stimulation by the T-cell Receptor (TCR) complex is necessary for T-cell response to the tumor.

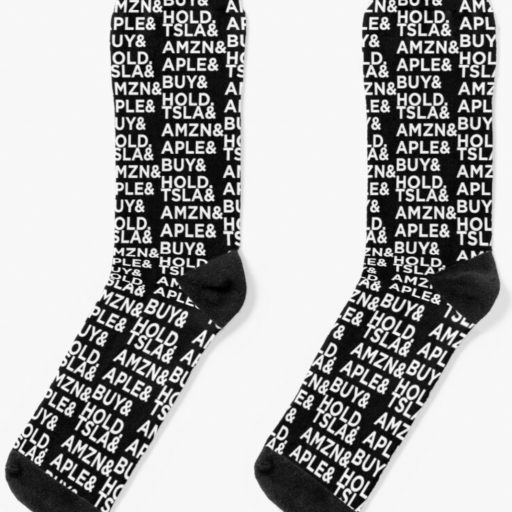

If a dose can be found that is efficacious without safety issues, the company could have a real winner on its hands. As we can see in the CT26 (Colorectal cancer) model below, significant numbers of Complete Responses (CR) were seen in mice in a dose dependent manner. Data from the study is expected sometime near the end of 2020, likely at SITC again.

What has also caught our attention here is the recent aggressive buying by BioValue Fund (BVF). Not only has the fund brought its entire ownership of FPRX to near 22% as of December 2019, BVF also has recently changed its filing status from a 13G to a 13D, which indicates the fund intends to be an activist here. Many would believe that becoming an activist in a public company means that said activist will have a hostile relationship with the company it becomes involved in, but this is not actually the intention in many cases - often times an activist has a positive relationship with management and its board of directors.

In our experience with activism, it’s only when a company refuses to consider the opinions of a large shareholder that provokes said large shareholder to take a more adversarial position.

In 2017, BVF became an activist investor in Xoma Corp (XOMA) when the stock was around $7 a share. Since that time, the stock reached a high of nearly $37 a share, with the current trading price of XOMA around $25. Xoma, at the time of the BVF’s activist involvement, was burning way too much cash and was operating within a single model premise. BVF helped to change the business model at Xoma, and is currently still actively involved with the company who just recently engaged a rights offering, in which BVF has an active part in.

BioValue Fund is run by a man named Mark Lampert, who has had a good deal of success investing in dev. Biotech over the years;

Mr. Lampert is the founder and General Partner of BVF Partners L.P. (“BVF”), a San Francisco-based, private biotechnology investment firm established in 1993 that manages the Biotechnology Value Fund, L.P. and related entities. Mr. Lampert has been active in the biotechnology industry since 1984, having served on the boards of directors of numerous public and private companies. Prior to forming BVF, Mr. Lampert was a Vice President at the investment banking firm Oppenheimer & Co and the founder of Biotechnology Royalty Corp., aimed at pooling university biotechnology patent royalties. Mr. Lampert was previously employed by Cambridge NeuroScience, G.D. Searle & Co., and the Boston Consulting Group. He is a founding donor to the Lampert-Byrd Foundation and GiveDirectly.org. Born and raised in Ann Arbor, Michigan, Mr. Lampert holds an A.B. with honors in Chemistry from Harvard College and an M.B.A. from Harvard Business School.

Interestingly, the day that BVF changed from a 13G to a 13D activist filer on FPRX, the former CEO of the company who was still the chairman of the board of directors stepped down. We do not think this was a coincidence, and we think BVF is actively engaged here to assist in several possible outcomes. One such outcome here is an earlier than expected partnership with the company’s Bema asset.

As per the Nov. 2019 earnings call, FPRX management clearly stated that it has stopped enrollment with the Phase 3 Bema trial at 140 patients, but the clinical identifier for this trial clearly shows that in Japan, not only has the company not stopped enrollment (which we mention earlier in this article), but has added a new center as of Dec.9th, 2019 (scroll down to the bottom of the linked page to see new center addition and active Japanese centers still recruiting).

We find this development to be quite curious and speculate there’s a connection with BVF's new activist position, and the former CEO/recently stepped down chairman. What exactly the connection is here we obviously do not know, but it could be related to a potential earlier than expected partner.

The company has stated that it’s interested in finding a partner for Bema, but did in fact guide this would not occur until after it has had its ‘futility look’ at the data this summer. However as prior mentioned, BVF’s activist position and the chairman of board stepping down could indicate a change of plans here.

FGFR2 over expression in Gastric cancer is serious unmet need, especially throughout Asian countries. This is right up Takeda Pharmaceutical’s (TAK) alley with its stated Access to Medicines (AtM) strategy.

This strategy is aimed at increasing access to its innovative and potentially life-saving medicines for patients with some of the highest unmet medical needs. For decades, the company has provided product, funding and access in many parts of the world, based on regional needs. The new AtM strategy builds on that by focusing on geographies and therapy areas with the highest unmet need.

Takeda targets high unmet needs with a focus on geographical niche markets. Could this be why the Japanese centers were left open for recruitment in the Bema trial, and why a new center was added after the early Nov. 2019 earnings call? Tak's main area of operations are in Japan, so a possible synergistic and logistic partnership here makes a lot of sense

On The Nov. call, FPRX did state that most of the patients enrolled in the Bema trial did so in the summer of 2019. However, we estimate at least 30 patients enrolled from October to December 2018 who would potentially be evaluable now.

With the trial design listed as double masking and not quadruple masking (certain company management may not be blinded to such data as they alluded to in its Nov. 2019 earnings call), the company may have taken a look at the data available as of December 2019, and may have estimated that the data was robust enough to enter into partnership talks now. Obviously, this is pure speculation on our part but we think the speculation is warranted based on the recent changes we have seen since FPRX's Nov. earnings call.

Let’s take a look at FPRX’s balance sheet to see why the company may have decided to do this;

Balance Sheet

| Total Cash (mrq) | $185.99M |

| Total Cash Per Share (mrq) | 5.3 |

| Total Debt (mrq) | $50.52M |

| Total Debt/Equity (mrq) | 28.31 |

| Current Ratio (mrq) | 6.93 |

| Book Value Per Share (mrq) | 5.08 |

Cash Flow Statement

| Operating Cash Flow (TTM) | -$136.82M (too much burn) |

| Levered Free Cash Flow (TTM) | -$78.55M |

We can see from the above, that FPRX burns way too much cash, and is the likely primary reason that the former management was 'kicked to the curve.' The Bema Phase 3 trial in terms of the over large N number target was clearly a mistake (a smaller N30 number would have sufficed for potential AA registration in our opinion and goes to our point about that number being evaluable now).

We feel BVF may also see what we are seeing here, and may have advised the company to cut the spending on this trial at this time and look for a partner now, and not later on.

Not only would this cut costs, but if Takeda or another big pharma was to partner Bema now, the company would realize both a cost saving by burning less money, and a net revenue/value addition while tethering the remainder of their pipeline.

FPRX certainly has a lot of risk here, but we also feel the company has been grossly oversold so it's a matter of entry level pricing, and we think the current level around $5 a share is a fair entry point.

The FPRX pipeline has massive potential but management does need to make a splash this year in terms of delivering data, cutting costs, and value adding a partner as stated above. If management can accomplish this, then FPRX would see a stock price much higher than the current pps. But, if management cannot accomplish these, the stock price could see a strong depreciation from its current levels.

With FPRX’S deep pipeline that addresses high unmet-needs, if one of these assets data hits this year then FPRX could be a multi-bag gainer, and that is our cautious bull case here.

Our upside price target which assumes successful outcomes this year, which also assumes normal 'risk on' market condition is around $15 - $30 a share. If management 'drops the ball' and multiple data fails, then we think $1.50 - $2 a share is the downside risk.

Disclosure: I am/we are long FPRX.