ArQule (NASDAQ: ARQL)

ArQule engages in the research and development of cancer therapeutics directed toward molecular targets and biological processes. Its lead product candidate Tivantinib (ARQ 197) is an inhibitor of the c-Met receptor tyrosine kinase, which is in Phase 3 clinical trial for the treatment of liver cancer and colorectal cancer (CRC). The company also develops ARQ 621, an inhibitor of the Eg5 kinesin motor protein that has completed Phase I trial; ARQ 736, an inhibitor of the RAF kinases, which is in Phase I clinical trial; ARQ 761, an activator of the E2F-1 damage response/checkpoint pathway; and ARQ 087, an inhibitor of fibroblast growth factor receptor that is in pre-clinical stage. It has partnership agreement with Daiichi Sankyo Co., Ltd. and Kyowa Hakko Kirin Co., Ltd

The lead product candidate is Tivantinib (ARQ 197), an orally administered, small molecule inhibitor of the c-Met receptor tyrosine kinase. C-Met is a promising target for cancer therapy based on its multiple roles in cancerous cell proliferation, tumor spread, new blood vessel formation and resistance to certain drug therapies. Arqule and its partners, Daiichi Sankyo Co., Ltd. and Kyowa Hakko Kirin Co., Ltd, are implementing a clinical development program designed to realize the broad potential of Tivantinib as a well-tolerated single agent and in combination with other anti-cancer therapies in a number of disease indications. The company’s strategy is to focus on the most promising indications within the clinical programs based upon data that is continually generated. Its leading indications include liver cancer, non-small cell lung cancer, and colorectal cancer. The company is also completing earlier-stage combination therapy trials with Tivantinib and other anti-cancer agents that may provide data to support later-stage trials in additional indications.

On October 16, 2012, the company announced a Special Protocol Assessment agreement with the U.S. Food and Drug Administration for the design of a pivotal Phase III trial of Tivantinib in patients with HCC. The Phase III trial will be a randomized, double-blinded study of Tivantinib as single agent therapy in previously treated patients with MET diagnostic-high inoperable HCC. The primary endpoint is overall survival in the intent-to-treat population, and the secondary endpoint is progression free survival in the same population. Approximately 300 patients are planned to be enrolled at approximately 120 centers worldwide.

ArQule has advanced into Phase III clinical with ARQ 197. C-Met is a promising target for cancer therapy, as evidence suggests that it plays multiple roles in cancerous cell proliferation, tumor spread, new blood vessel formation and drug resistance. The company believes that the inappropriate expression of c-Met in many cancers and its involvement in multiple signal transduction pathways affecting tumor growth and metastasis render it a compelling target for cancer therapy.

Oncology research and development activities are increasingly focused on kinases, which play pivotal roles in modulating diverse cellular activities and have been implicated as important mediators of certain forms of cancer and other diseases. The success of kinase inhibitors such as Gleevec and Nexavar has focused attention on the kinase field, resulting in the increased development of next-generation inhibitors that target cancers and other diseases such as inflammation. The current market for protein kinase inhibitors is estimated to exceed $7 billion, and by 2020, small-molecule kinase inhibitors are projected to generate collectively annual revenues greater than $25 billion.

ArQule has extensively studied the mechanism by which ARQ 197 selectively inhibits its target c-Met receptor kinase. These studies have revealed the molecular and structural basis by which ARQ 197 targets c-Met. ARQ 197 inhibits c-Met autophosphorylation and is selective for the inactive or unphosphorylated form of c-Met. Elucidation of this novel mode of inhibition of c-Met has opened up the opportunity for the design and development of similar selective inhibitors for other kinases.

Drug discovery at ArQule utilizes a proven innovative and efficient drug discovery engine which employs a proprietary structure-based drug design technology known as the ArQule Kinase Inhibitor Platform(AKIP™). This platform targets inactive forms of kinases that have pivotal roles in cancer and other diseases. AKIP integrates in silico drug design, parallel robotic chemistry, and novel assay development expertise to create non-ATP competitive inhibitors that interact with these kinases in novel binding modes. Inhibitors identified through AKIP are optimized into drug candidates having the appropriate efficacy and selectivity for their target with minimal side effects.

The company believes it has within this platform the capability to rationally design novel kinase inhibitors that encompass new chemical spaces and allow for an expanding intellectual property estate. It anticipates that these novel kinase inhibitors, when targeted against selected therapeutically relevant kinases, will have utility in a broad range of human diseases in addition to cancer.

The company is seeking to expand the applications of this proprietary drug discovery platform through collaborative research programs as well as through our own internal discovery and development activities in multiple therapeutic areas.

ArQule has a collaboration with Daiichi Sankyo Co., Ltd. to apply its AKIP technology in the discovery of therapeutic compounds that selectively inhibit certain kinases in the field of oncology.

It is also independently applying AKIP to the discovery of inhibitors of fibroblast growth factor receptor (FGFR). Progress to date has resulted in a series of small molecule inhibitors of FGFR that are not ATP-competitive and show potent anti-tumor activity in FGFR-driven human and animal cancer models.

Daiichi Sankyo (DS) is ArQule's co-development worldwide partner for ARQ 197, (except Asia) and paid ArQule $60 Mil upfront, with another $560M due for potential milestones and tiered double-digit royalties. The most recent milestone was a $25M payment for the initiation of the MARQUEE Phase III trial. DS retains all ex-Asia commercial rights, with ArQule retaining the US co-commercialization rights. There has been some speculation that DS is considering acquiring ArQule, but I have yet to hear from a real source on this front regarding this.

Right off the bat, it seems to me that ArQule is very undervalued speculation wise, with its current market cap of $178.30M.

| Balance Sheet | |

| Total Cash (mrq): | 120M (estimated) |

| Total Cash Per Share (mrq): | 1.33 |

| Total Debt (mrq): | 1.70M |

| Total Debt/Equity (mrq): | 1.99 |

| Current Ratio (mrq): | 2.11 |

| Book Value Per Share (mrq): | 1.37 |

| Cash Flow Statement | |

| Operating Cash Flow (ttm): | -41.54M (Yearly) |

| Levered Free Cash Flow (ttm): | -16.95M |

Right off the bat, it seems to me that ArQule is very undervalued speculation wise, with its current market cap of $178.30M.

Daiichi Sankyo (DS) is ArQule's co-development worldwide partner for ARQ 197, (except Asia) and paid ArQule $60 Mil upfront, with another $560M due for potential milestones and tiered double-digit royalties. The most recent milestone was a $25M payment for the initiation of the MARQUEE Phase III trial. DS retains all ex-Asia commercial rights, with ArQule retaining the US co-commercialization rights.

Potential catalyst trade:

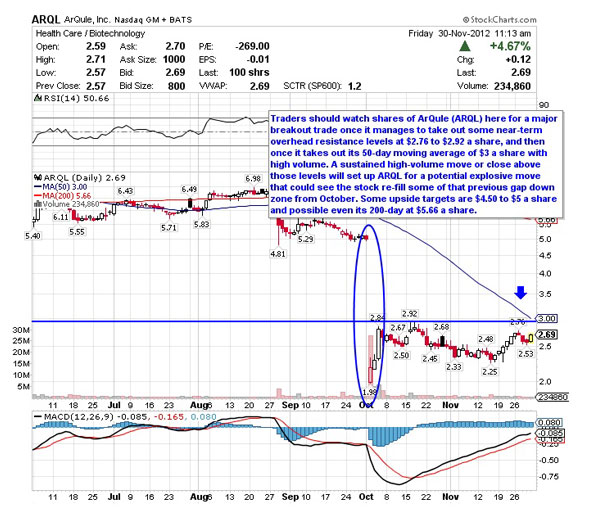

Phase II top-line data covering CRC is due out by the end of this year/early next year for ARQ 197. The data release will estimate the difference in progression-free survival (PFS) between the study and control arms in subjects with CRC with wild-type KRAS who have received front-line therapy. Positive data here would likely gap the stock up considerably, so traders should keep an eye out for this.

Wi an Eg5 Inhibitor, a BRAF Inhibitor, an FGFR Inhibitor, and an AKT Inhibitor - a deep pipeline along with the near term catalyst event of top line Phase II data, makes the company's $178.30M market cap undervalued for a mid stage Oncology biotech in my opinion, and also makes for a good catalyst trade opportunity

| Net Institutional Purchases - Prior Qtr to Latest Qtr | |||

| Shares | ||

| Net Shares Purchased | 5,640,490 | ||

| % Change in Institutional Shares Held | 10.48% | ||

Institutions have increased their stake by over 10% in the company lately, which is usually a good sign.

Also of note, Edison Investment Research values ArQule at $5.40 a share, which equates to a market cap of about $376M, more than double the company's current market cap.

The above chart was taken from Robert Pedone's Street article published a couple of weeks ago. I spoke to Robert yesterday to get his updated take on the charts, and we both agree that if the stock breaks past $3 on decent volume, we could see an upwards gap fill to $4 rather quickly. With the data release expected any day now, I feel ArQule is a good long side trade for the short term, and with good data, possibly a longer term buy and hold.

The Biopharma segment of the market is rather hot these days with companies like Sarepta (NASDAQ: SRPT) and Acadia (NASDAQ: ACAD) recently seeing large price gaps up on positive data releases.

My short term price target opinion is $4 a share, and a 1 year target over $10 if the company's platform proves successful in 2013.